1. Audits by CPAs

Japan's CPA system was created alongside post-war securities market reforms, positioning CPAs as expert auditors for listed companies.

Subsequently, the Law of Special Measures of the Commercial Code made audits of listed companies mandatory, after

which audits of a wider range of organizations became mandated by law, steadily expanding the fields in which CPAs perform

audits. In recent years, the use of CPA audits in the non-profit sector has been increasing, and, based on the Revised

Agricultural Cooperative Law promulgated on April 1, 2016, from fiscal 2020 onward, agricultural cooperatives with more than

¥20 billion in deposits and cooperative associations with more than ¥20 billion in liabilities will be required by law to undergo audits by accounting auditors (CPAs or audit corporations).

2. Number of Accounting Auditors

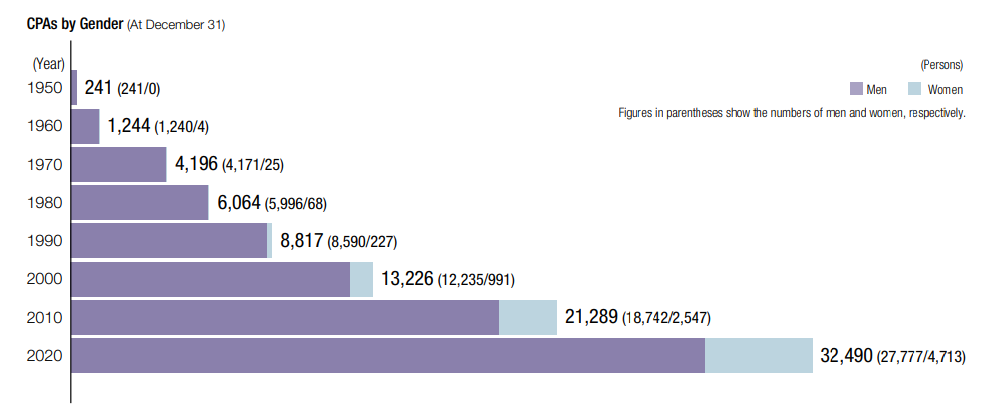

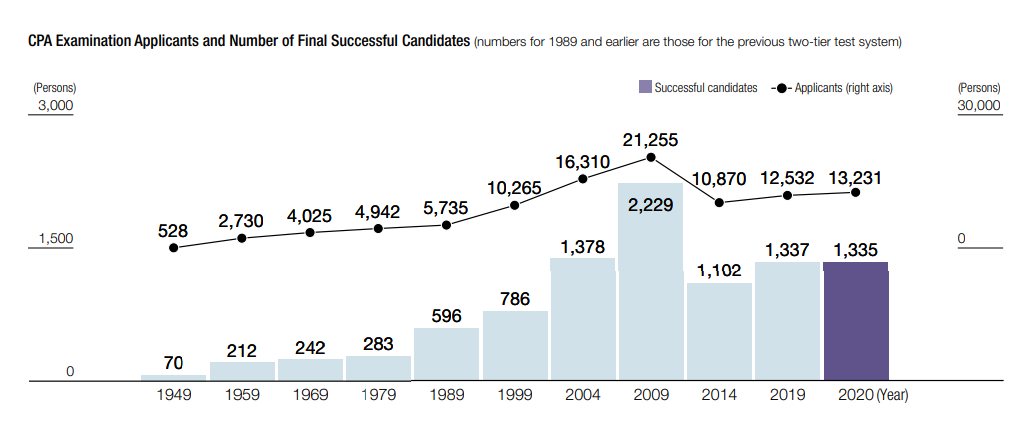

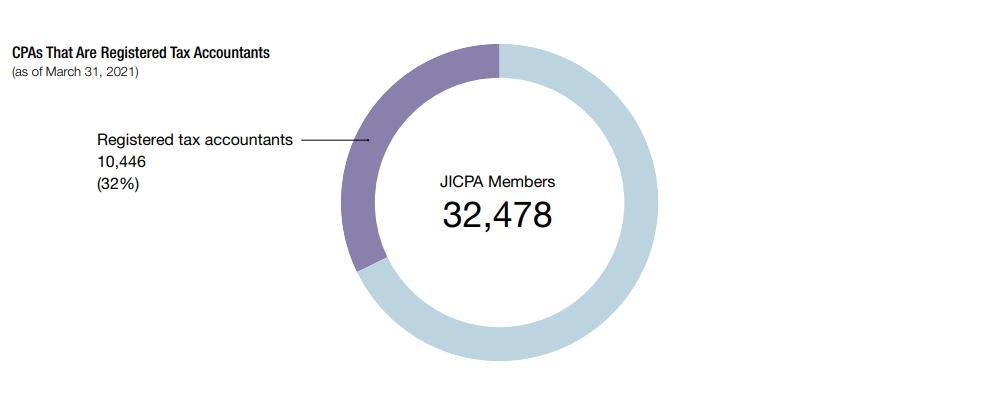

The number of CPAs in Japan is steadily rising. As of March 31, 2021, the number of CPAs stood at 32,478.

1951 saw the first registration of female CPAs (2 individuals). Today, approximately 15% of Japan's CPAs are women. The

portion of successful CPA examination candidates who are women has been around 20% in recent years, reaching 24.6% in

2020, indicating that the proportion of women among CPAs will continue to increase going forward.

We have established targets regarding the proportion of women among our members and associate members and among

successful CPA examination candidates. We are examining measures to achieve these targets(see page 48 of JICPA Annual Report 2021).

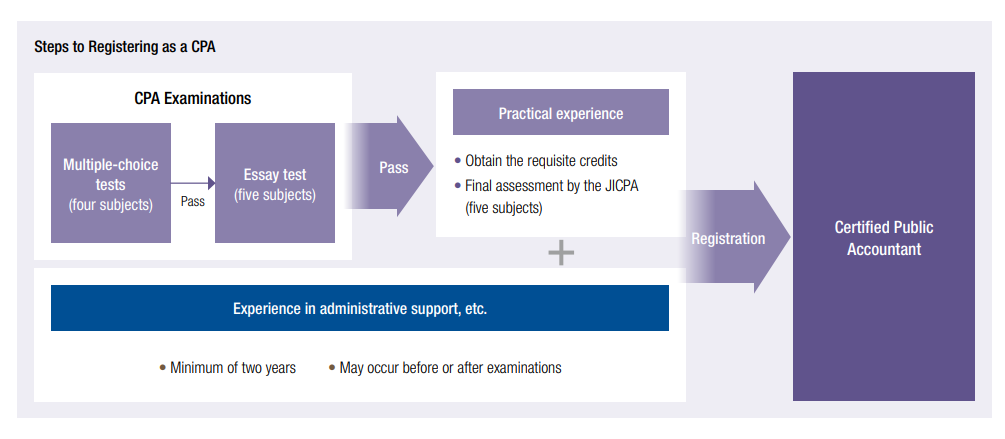

To become a CPA, an applicant must pass the CPA examinations (multiple-choice tests and essay tests), complete at least two years of practical experience, undergo a professional accountancy education program administered by the Japan Foundation for Accounting Education and Learning, and pass a final assessment by the JICPA. After confirmation from the prime minister, the applicant's name is added to the register of CPAs.

CPAs of Japan and of other countries practicing in Japan are required to register as members of the JICPA. This registration is mandated by the CPA Act, and is necessary for CPAs to represent themselves as such to the public. Registration as members of JICPA means they are registered to practice as active licensees.

In addition, the types of individuals shown below may become associate members of the JICPA (non-mandatory).

3. Areas of CPA Activity

In addition to accounting, CPAs work in a wide range of fields and roles in society as accounting experts.

1. Tax-Related Work

By registering as a tax accountant, CPAs can carry out tax-related work. These CPAs prepare tax declarations, provide tax-related consultation, and use their wide-ranging knowledge to provide counsel and advice in specialized tax matters, such as tax duties related to M&A and international taxation.

2. Consulting

CPAs provide counsel and advice in all areas of management, including drafting management strategy, capital procurement, establishing internal controls, securities listing, organizational reform, and due diligence.

3. Professional Accountants in Business (PAIB)

CPAs work at corporations and other public and private organizations. The number of CPAs working at organizations other than CPA offices and audit companies has been rising in recent years.

4. Outside Directors and Corporate Auditors

Japan's Corporate Governance Code for listed companies was adopted in 2015 and amended in June 2018. The Code states that "Companies should appoint at least two independent directors" and that "persons with appropriate experience and skills as well as necessary knowledge on finance, accounting, and the law should be appointed as kansayaku [corporate auditors].* In particular, at least one person who has sufficient expertise in finance and accounting should be appointed as kansayaku." In accordance with these provisions, the number of CPAs serving as outside directors and corporate auditors has been rising, and currently stands at more than half of all listed companies.

* Also known as Audit & Supervisory Board Members

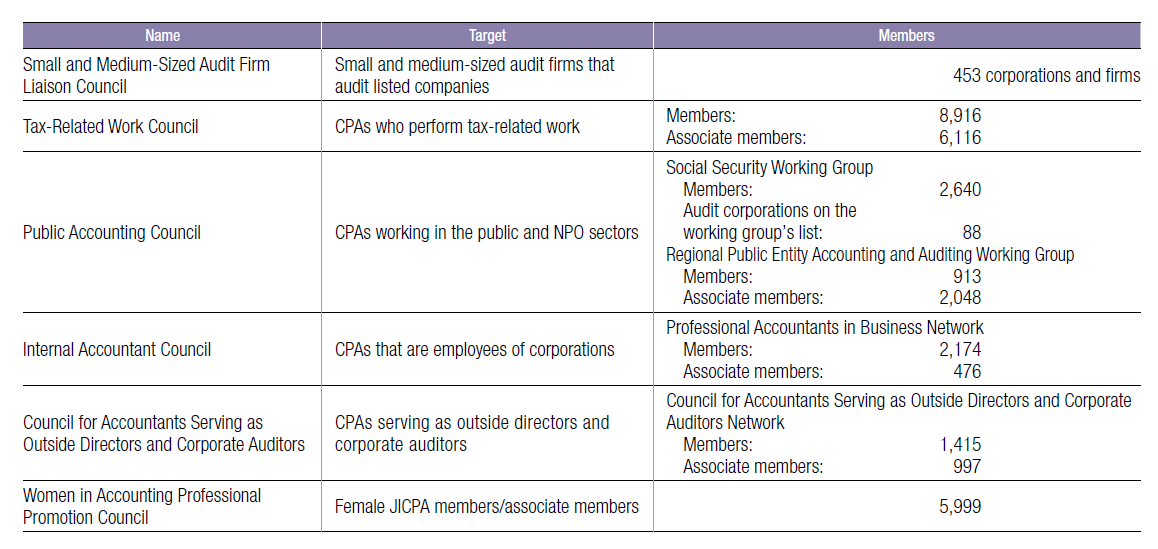

To support CPAs working in a variety of fields, the JICPA has established a number of specialized councils. The number of registered members of each council and of the working groups, etc., within each council are as follows (as of March 31, 2021).