Overview of Continuing Professional Development (CPD)

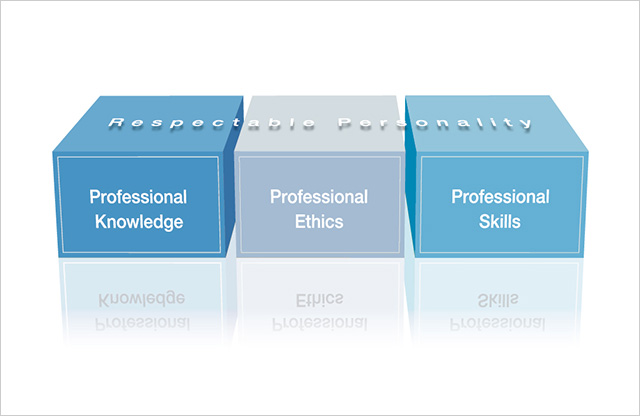

In accordance with Article 28 of the CPA Act (https://www.fsa.go.jp/news/20/sonota/20081210-1/01.pdf), the JICPA requires its members to undergo CPD activities each year. Members are required to earn prescribed number of credits each year to maintain and develop their competence in providing high quality professional services. To ensure compliance with the JICPA code of ethics, and to maintain the quality of services provided by members, each member is required to earn credits in professional ethics and tax each year. For those members engaging in statutory audits, credits in audit quality and fraud are also required annually.

CPD Requirements

- (a) For every reporting year, CPAs must earn the required number of credits and report to the JICPA.

- (b)The "required number of credits" constitutes;

- (i) A sum of 120 credits over the course of three years,

- (ii) A minimum of 20 credits annually, and

- (iii) Annual requirement of 2 credits each in "Professional Ethics" and "Tax," and 6 credits in "Audit Quality and Fraud" for those engaging in statutory audits.